Renters Insurance in and around Hellertown

Looking for renters insurance in Hellertown?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- 18020

- 18031

- 18034

- 18036

- 18037

- 18040

- 18045

- 18049

- 18051

- 18053

- 18059

- 18066

- 18076

- 18077

- 19878

- 18080

- 18085

- 18088

- 18092

- 18920

- 18955

- 19529

- 19530

- 19534

Protecting What You Own In Your Rental Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented townhouse or apartment, renters insurance can be the right decision to protect your belongings, including your pots and pans, coffee maker, silverware, sports equipment, and more.

Looking for renters insurance in Hellertown?

Coverage for what's yours, in your rented home

Why Renters In Hellertown Choose State Farm

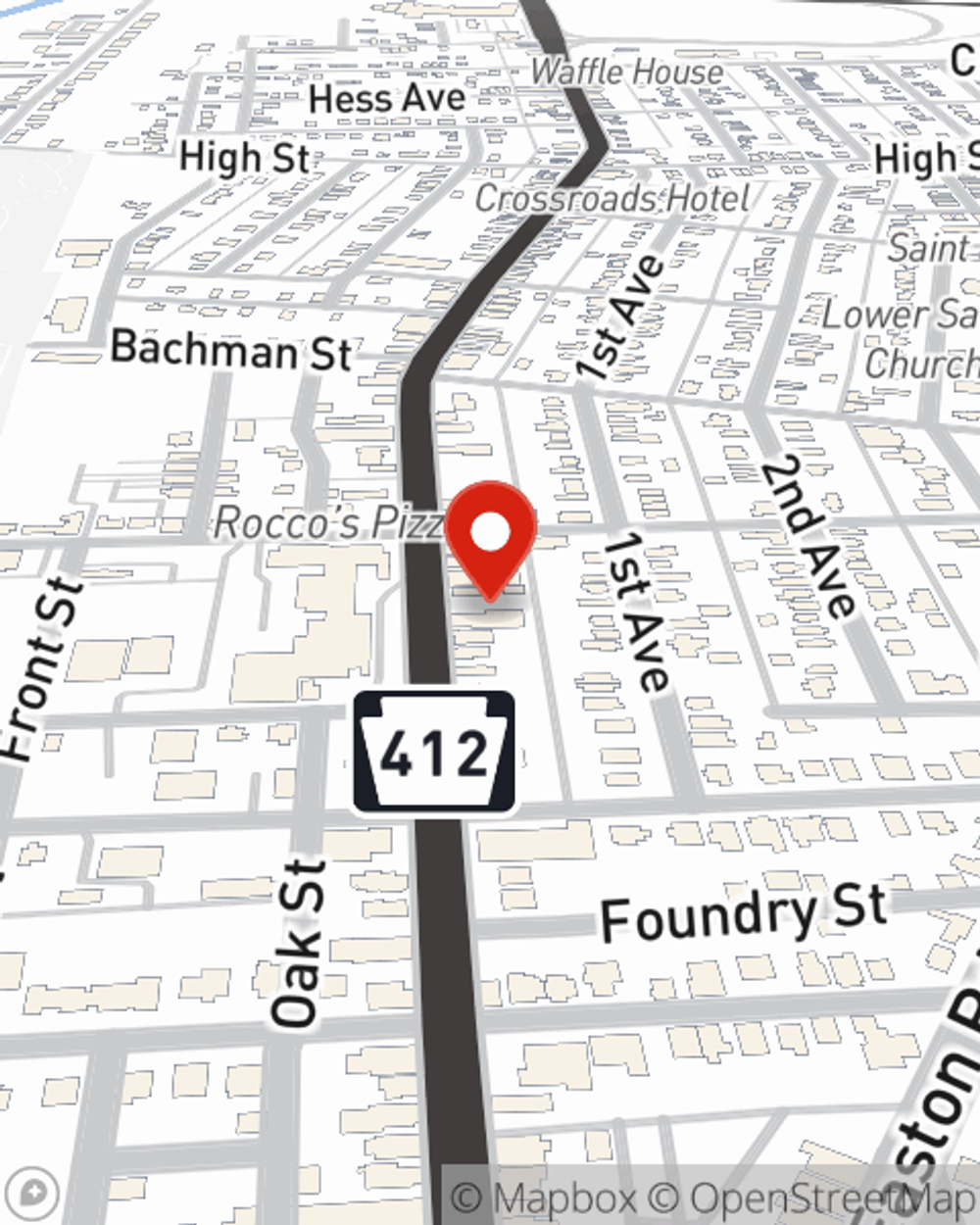

When renting makes the most sense for you, State Farm can help guard what you do own. State Farm agent Jim Gardner can help you generate a plan for when the unexpected, like an accident or a fire, affects your personal belongings.

There's no better time than the present! Visit Jim Gardner's office today to learn how you can protect your belongings with renters insurance.

Have More Questions About Renters Insurance?

Call Jim at (610) 838-1800 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Jim Gardner

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.